Advanced Billing provides the ability to define custom taxes that are collected when a user subscribes to your product.

Taxes are defined on the site level and are available to all product families of the site. To apply a tax to a product or component, you first create the tax and then mark the product or component as taxable.

Creating a Tax

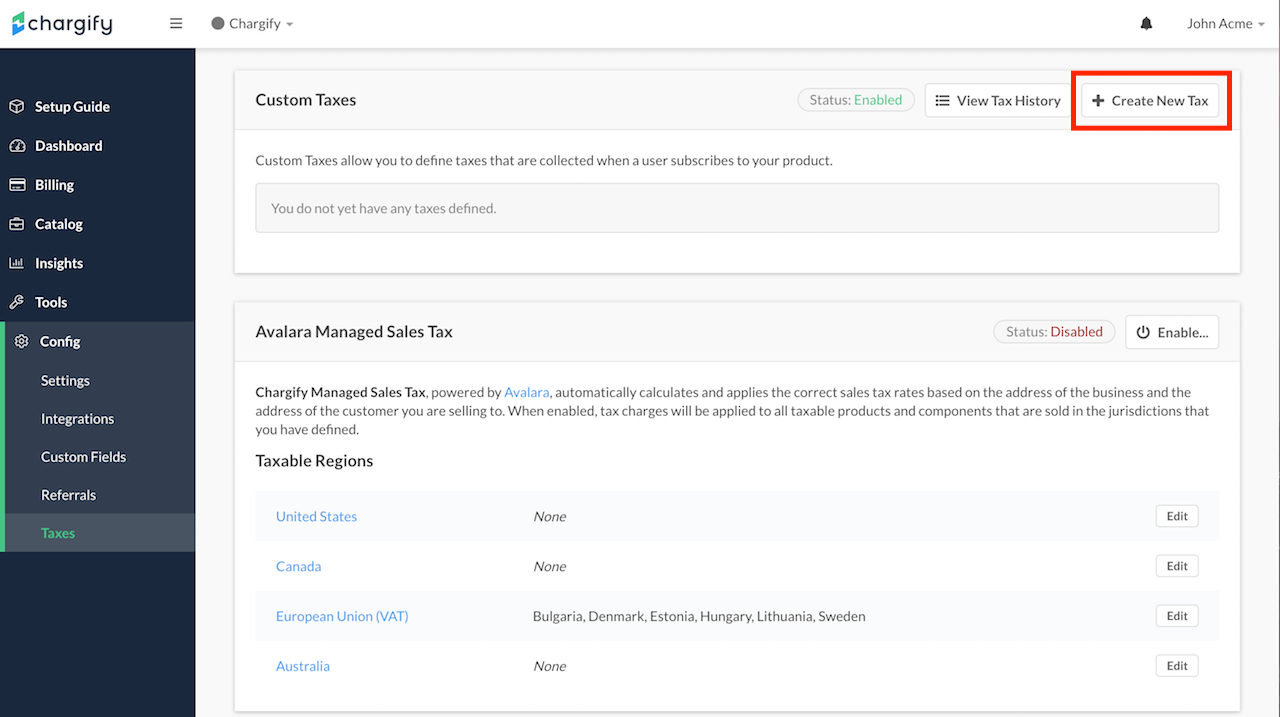

To create a new tax, click on the products tab at the top, and then click on the ‘Taxes’ button. From there, click the ‘Create New Tax’ button. There are 2 types of taxes, which we discuss below, general tax and European taxes.

Creating a new custom tax

General Tax

Example of general tax: Canadian GST/PST/HST, Australian GST, etc.

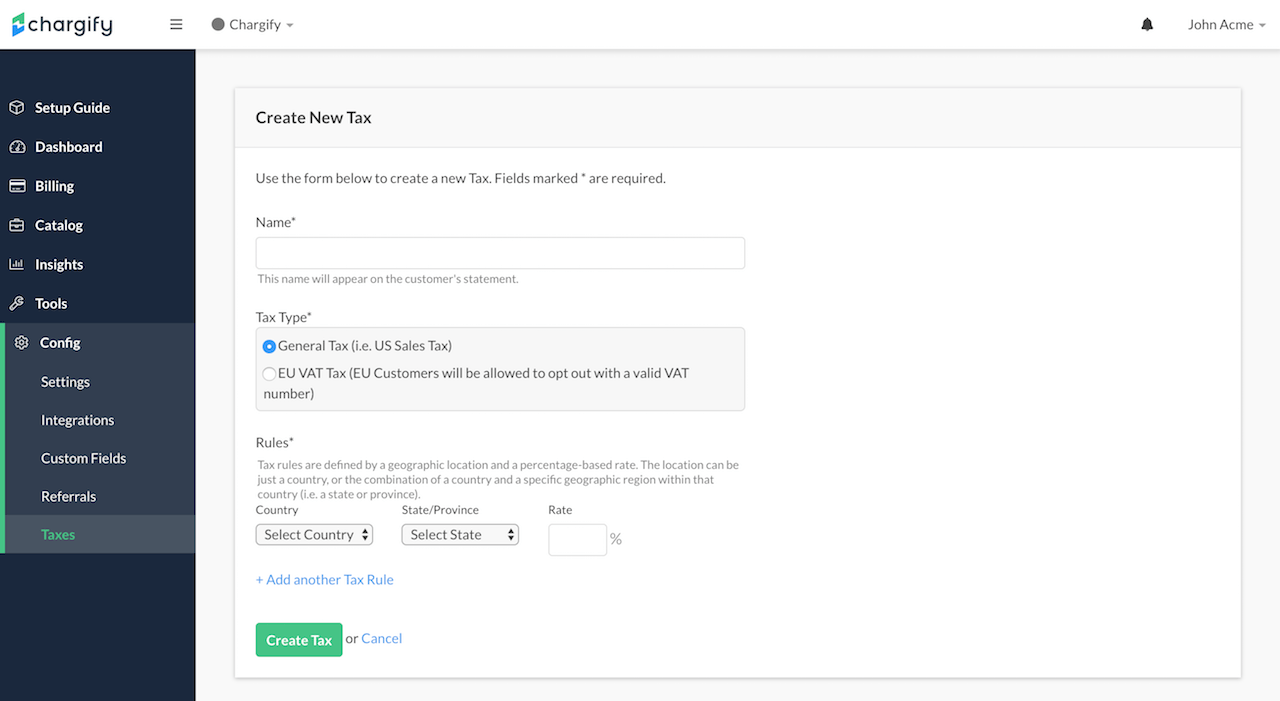

The general tax allows you to apply a percentage rate tax on a specific geographic region. The region may be as broad as an entire country or as specific as a state/province.

Create a new tax and select general tax

European Union – Value Added Tax

The EU VAT type works just like the general tax, with a few distinctions:

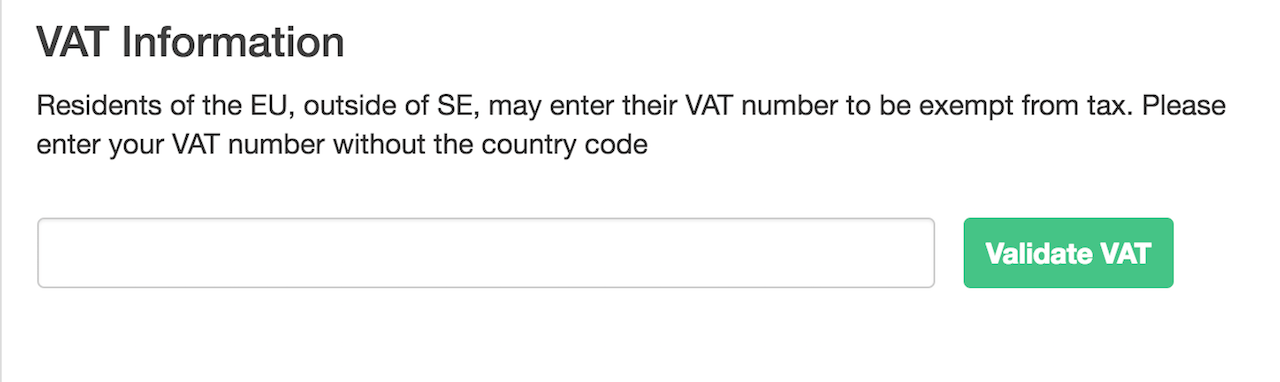

Tax rules can only be defined on the country level, not state/province EU customers are given the ability to opt out of the tax on the Public Pages if they provide a valid VAT number (Note: only customers outside of your own country are allowed to opt out.)

Option for adding VAT number in Public Signup Page

Tax Rules

In order to be as flexible as possible, Advanced Billing provides the ability to define your own tax scenarios. Taxes are comprised of one or more ‘Tax Rules’. A Tax Rule specifies a geographic region and a percentage rate to be applied to that region. The geographic region can be either an entire country, or a specific state/province within that country.

Marking Products and Components as Taxable

Unless otherwise specified, all products and components are NOT eligible for taxes. Once a tax is defined, you will need to update your existing products and components so that they can be taxed. To do this, edit the product or component and check the This product is subject to taxes checkbox.

For more information on applying taxes to Products, please refer to our Product documentation.

You will also want to ensure that you collect a Billing or Shipping address, depending on how you have defined the taxes to be calculated. To do this, edit the product and check “Require Billing Address” and/or “Require Shipping Address”.

Creating Taxable Subscriptions

In order for a subscription to be considered taxable, the subscription must have a valid shipping or billing address. The address information must be complete, and be formatted properly in order to correctly determine the tax locale of the charge.

Required Country Format for Taxable Subscriptions

Countries should be formatted as 2 characters. For more information, please see the following wikipedia article on ISO_3166-1.

For example, the official country code for Germany is DE, and the official country code for the United Kindom is GB.

Required State Format for Taxable Subscriptions

-

US States (2 characters): ISO_3166-2

-

States outside the US (2-3 characters): To find the correct state codes outside of the US, please go to ISO_3166-1 and click on the link in the “ISO 3166-2 codes” column next to country you wish to populate.

Coupons and Taxes

When applied in conjunction, taxes are applied to the total cost of the subscription AFTER the coupon adjustment has been accounted for.

Tax History

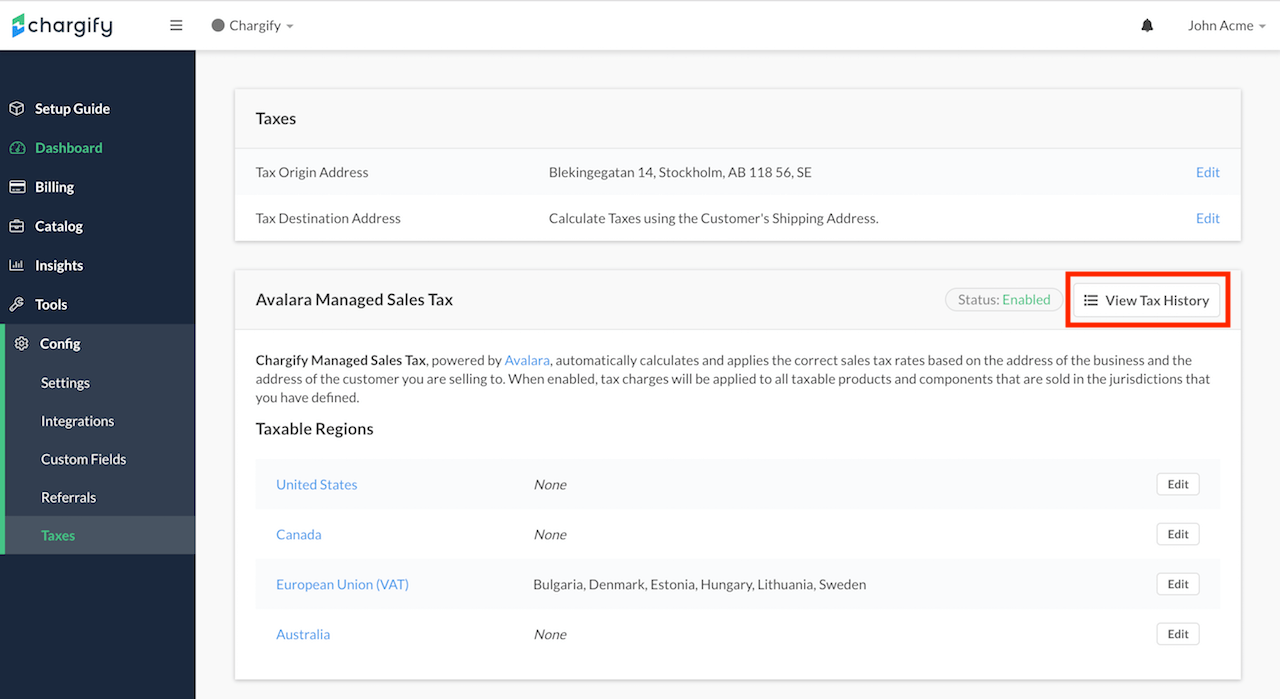

You can view and export a history of all tax charges by clicking the ‘View Tax History’ button at the top of the Taxes page.

View the contents of your site's tax history

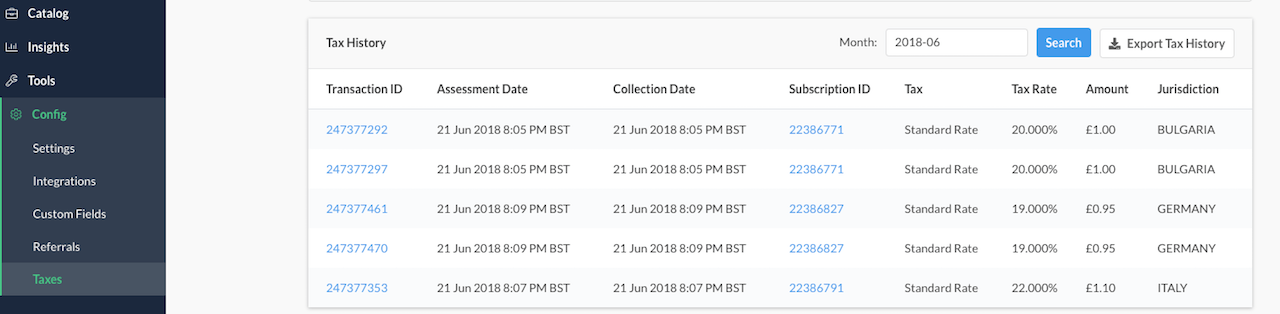

Here is a sample of what information the tax history page displays:

Table view of the site's current tax history

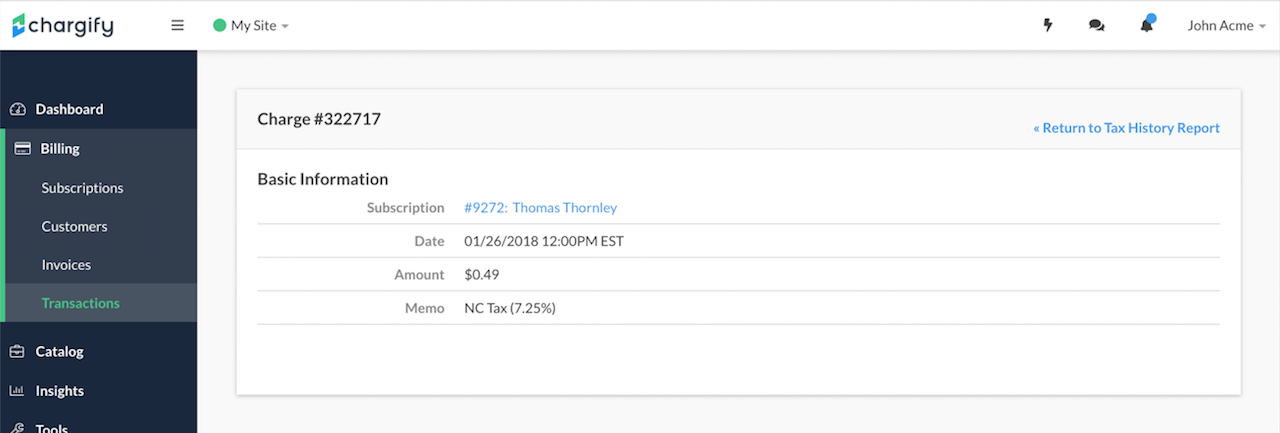

Select the transaction ID to inspect a particular tax application:

Individual tax transaction detail