Avalara AvaTax is a cloud-based solution automating transaction tax calculations and the tax filing process. Avalara provides real-time tax calculation using tax content from more than 12,000 US taxing jurisdictions and over 200 countries, insuring your transaction tax is calculated based on the most current tax rules.

Avalara Obtained Certifications:

Before we delve into how to connect your existing Avalara account to Advanced Billing, it’s important to ensure that merchants are aware of the rules surrounding taxing subscribers.

A few items must be in place within Advanced Billing to create a situation where tax is generated:

- The product (address required) or component must be taxable

- Your tax origin address / settings must be complete

- A subscriber must provide a full billing or shipping address

Additionally, within Avalara:

- Configure which countries and states are taxable

Creating Taxable Subscriptions

In order for a subscription to be considered taxable, the subscription must have a valid shipping or billing address. The address information must be complete, and be formatted properly in order to correctly determine the tax locale of the charge.

Full Address Required for Taxable Subscriptions

When using Avalara, Advanced Billing requires that you use complete addresses in order for your subscriber to be taxed appropriately. Partial addresses, such as country and zip code, are not acceptable as valid addresses in order to derive tax information from Avalara. The result of supplying partial addresses will be that your subscribers are not charged tax.

A complete address includes the following:

- Address 1 (50 characters maximum)

- Address 2 (optional, use when appropriate)

- City

- State (Required ISO format, see below)

- Country (Required ISO format, see below)

- Postal Code / Zip (11 characters maximum)

Required Country Format for Taxable Subscriptions

Countries should be formatted as 2 characters. For more information, please see the following wikipedia article on ISO_3166-1.

Required State Format for Taxable Subscriptions

-

US states (2 characters): ISO_3166-2

-

States outside the US (2-3 characters): To find the correct state codes outside of the US, please go to ISO_3166-1 and click on the link in the “ISO 3166-2 codes” column next to country you wish to populate.

Creating Taxable Products

If any settings are configured in Avalara to specify a particular product id as taxable, they will be ignored. Advanced Billing acts as the main location for controlling taxable products and defining the nature of the tax.

Configuring Taxable Jurisdictions

Unlike other tax features in Advanced Billing, where the taxable countries and states are configured inside Advanced Billing, this integration requires your team to configure this information inside Avalara. Go to Settings > Where you collect tax to fill this information.

Choosing the taxable jurisdictions is entirely dependent on your particular company’s needs. For any questions, we recommend contacting a tax professional. Avalara’s support is available as well for any questions on particular tax codes.

Connect to AvaTax

Find your AvaTax Credentials

In order to connect to Avalara you need to obtain account ID and license key. Please refer to Avalara FAQ for finding account id and license key.

Enable AvaTax for Advanced Billing Site

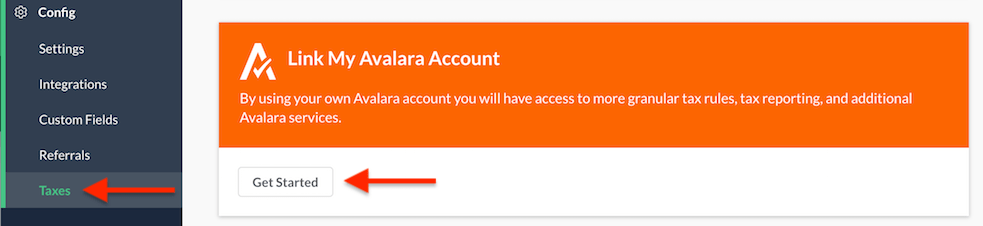

Find “Link My Avalara Account” panel and click “Get Started” button.

Go to Config / Taxes in the navigation panel.

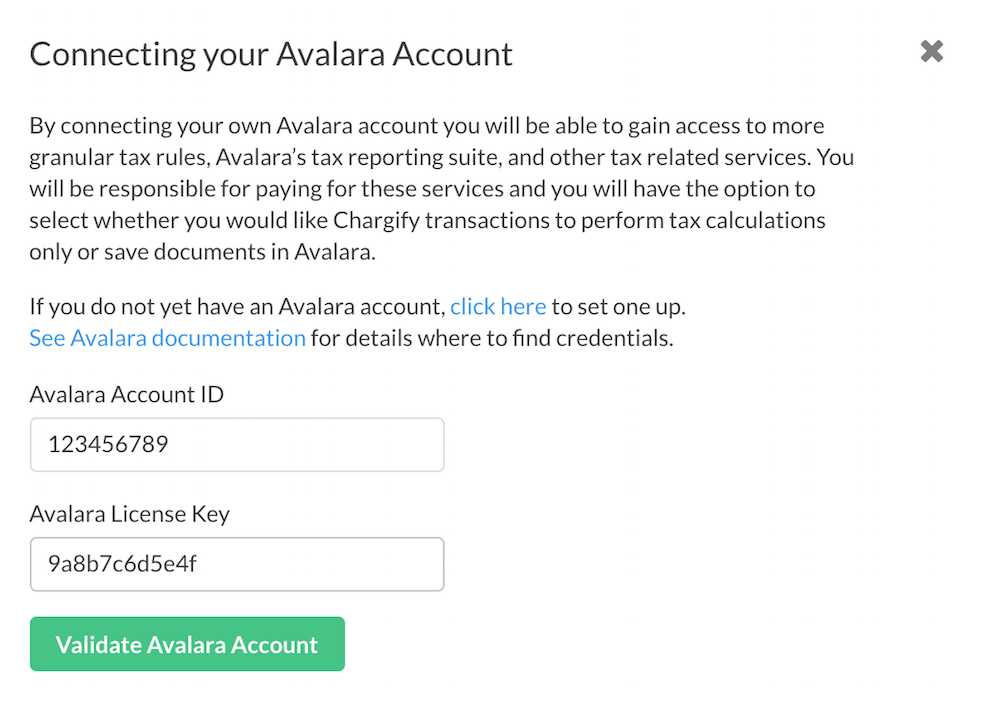

Enter your Avalara account id and license key and press "Validate Avalara Account".

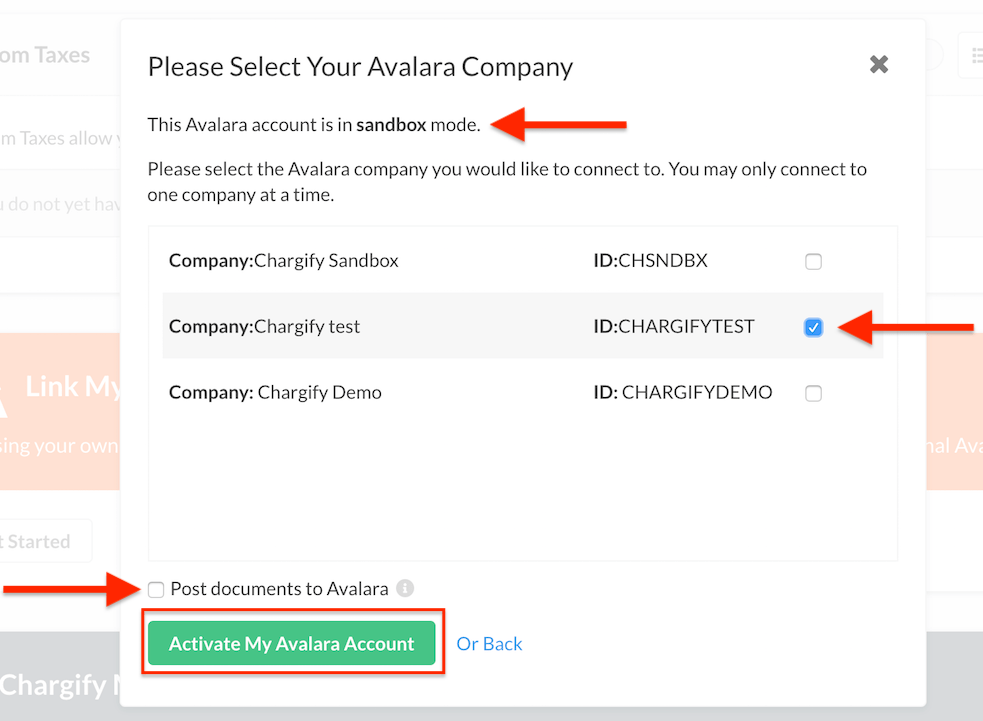

After providing valid credentials a modal will appear with list of your Avalara companies. Please select which one you want to connect with in Advanced Billing. At the top you can view if your Avalara account is in production or sandbox mode.

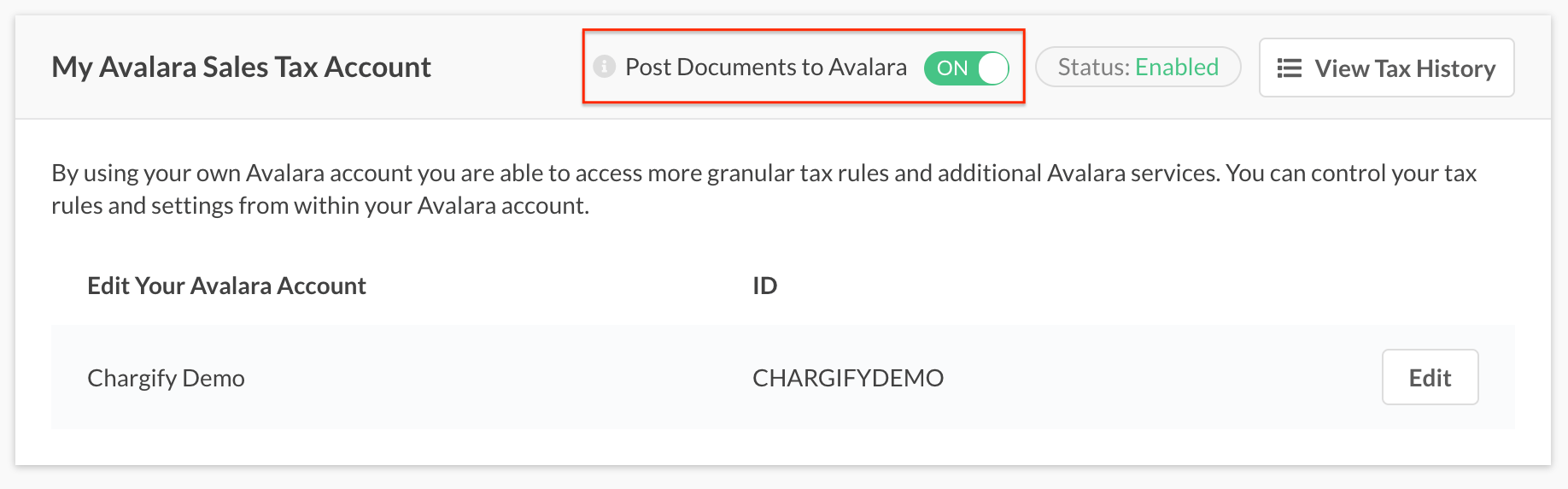

In order to commit transactions to Avalara you need to select “Post documents to Avalara checkbox.” You can change this option later.

List of Avalara Companies

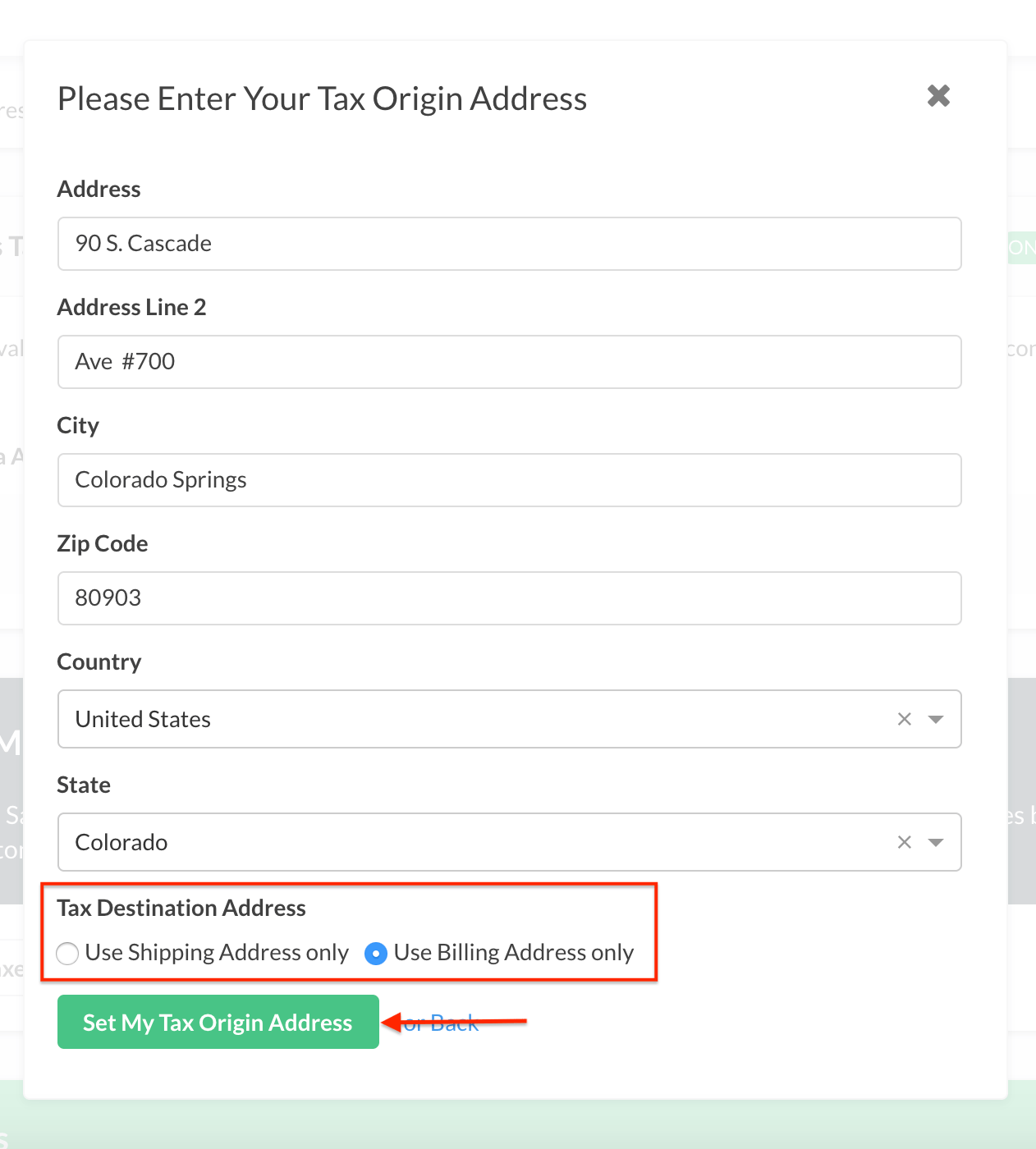

If you haven’t setup Tax Origin Address before you will need to provide your business’s address. If you had - please validate it. Avalara needs a full address on file to calculate the correct tax rates.

As a last step, please select tax destination address. To learn more please check our Tax Settings page.

After filling out the form, save changes by clicking "Set My Tax Origin Address" button

Post documents to Avalara

- Enabled: Enables tax document submission to Avalara’s AvaTax service for record keeping. With this setting enabled, transactions will be posted and committed to the AvaTax Admin Console which will allow you to gain access to reporting, tax filing, and other services from Avalara. Invoices for zero (or fully discounted) amounts will not be posted. Please be aware that Avalara charges more when you post documents. This may increase your Avalara bill.

The documents that are synced to Avalara include open/unpaid and nontaxable invoices, as well as refunds. For subscribers that are in a group, we will only sync segment / child invoices and not the corresponding consolidated invoice.

- Disabled: Advanced Billing will send only tax calculations to Avalara. No transactions will be saved in Avalara.

Example screen displaying Avalara enabled

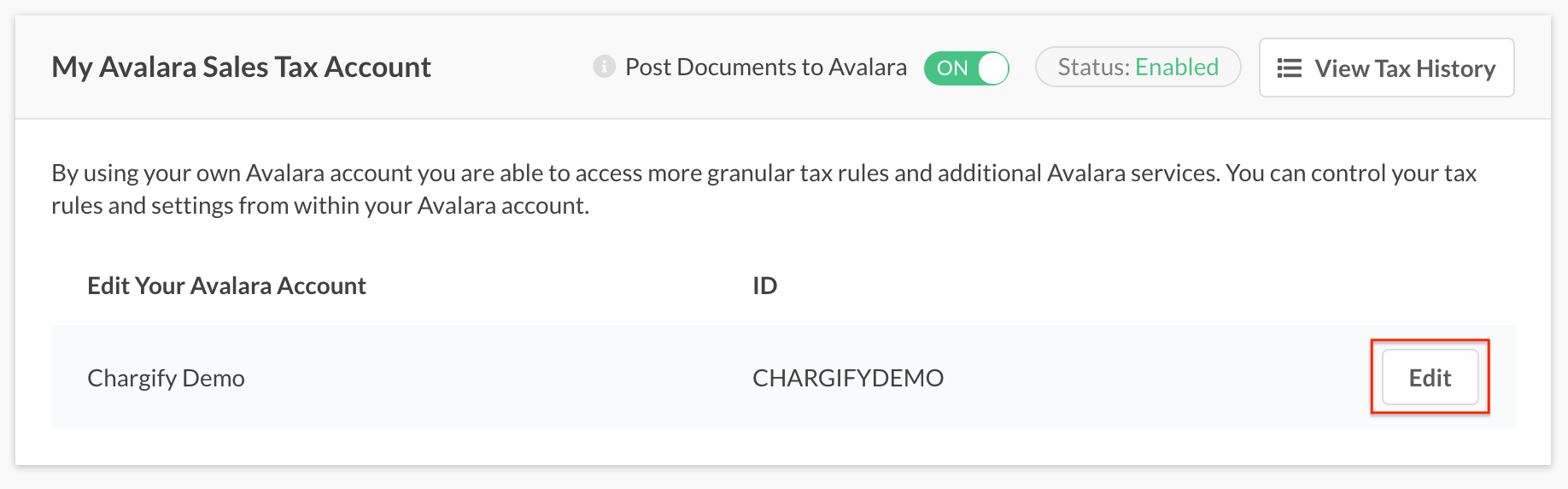

Change Avalara credentials or company

In order to change credentials (ie. from sandbox to production) click the Edit button. You will be able to change account credentials or select another company.

Edit your Avalara credentials

Invoice Billing Mappings between Advanced Billing and Avalara

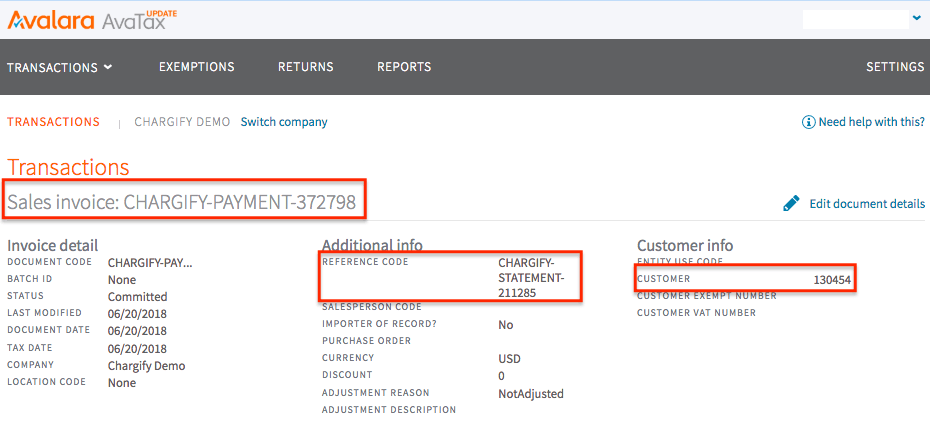

Payments mapping

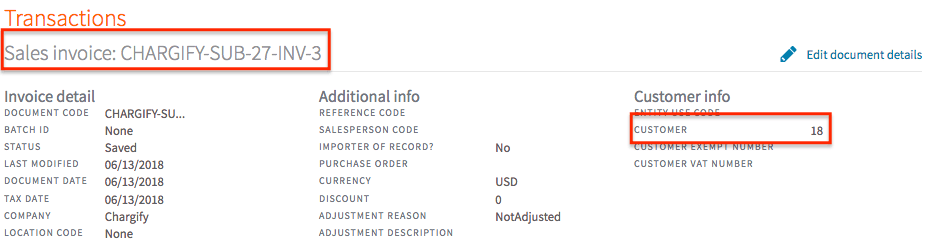

| From (Advanced Billing) | Prefix | To (Avalara) |

| Transaction ID | CHARGIFY-PAYMENT | DOCUMENT CODE |

| Statement ID | CHARGIFY-STATEMENT | REFERENCE CODE |

| Customer ID | N/A | CUSTOMER |

Payment mapping example

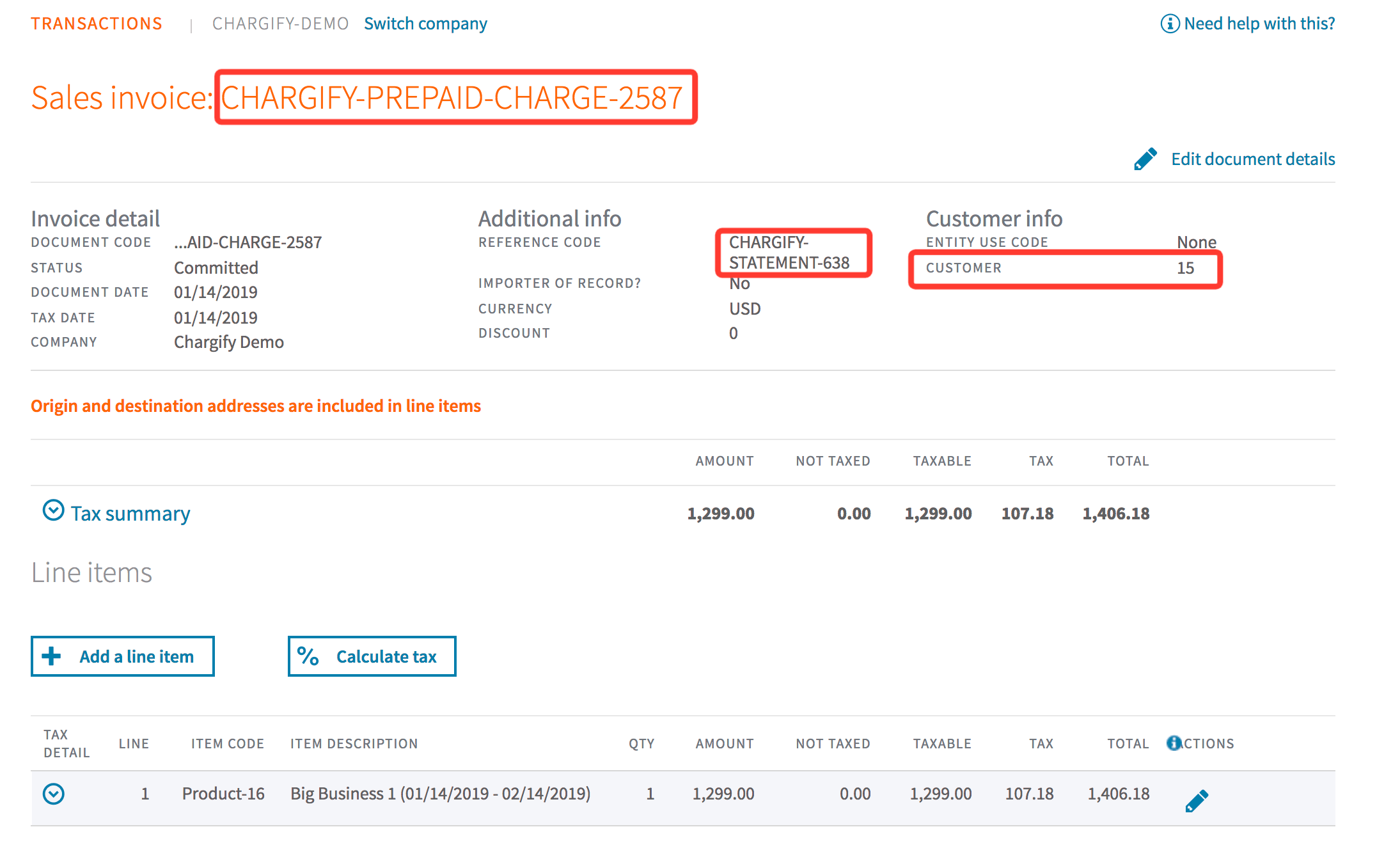

Charge (Prepaid) mapping

This will occur if automatic billing has been selected. If there is a current negative balance (credit) on the subscription, this pre-paid charge – covered by the existing credit will be applied to the full cost of a all statement’s charges. This will be marked in Avalara as prepaid using Record External Payment or Adjust Balance options.

Charges (Prepaid) sync happen during subscription renewal (at the end of period)

| From (Advanced Billing) | Prefix | To (Avalara) |

| Transaction ID | CHARGIFY-PREPAID-CHARGE-{charge_id} | DOCUMENT CODE |

| Statement ID | CHARGIFY-STATEMENT | REFERENCE CODE |

| Customer ID | N/A | CUSTOMER |

Charge (Prepaid) mapping example

Invoices mapping

| From (Advanced Billing) | Prefix | To (Avalara) |

| Subscription ID and Invoice ID | CHARGIFY-SUB-{subscription_id}-INV-{invoice_id} | DOCUMENT CODE |

| Unpaid (Status) | Saved | |

| Paid (Status) | Committed | |

| Customer ID | CUSTOMER | |

| Reference Code | N/A | Not used |

Invoices mapping

Invoices mappingRefunds mapping

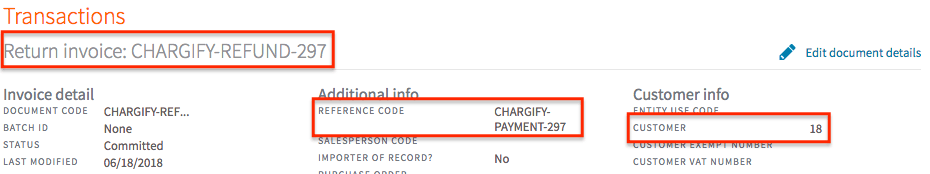

| From (Advanced Billing) | Prefix | To (Avalara) | Notes |

| Refund ID | CHARGIFY-REFUND- | DOCUMENT CODE | |

| Payment ID | CHARGIFY-PAYMENT- | REFERENCE CODE | |

| Invoice ID | CHARGIFY-SUB-{subscription_id}-INV-{invoice_id} | REFERENCE CODE | Applicable if refunded payment is related to invoice |

| Customer ID | CUSTOMER |

Refunds mapping

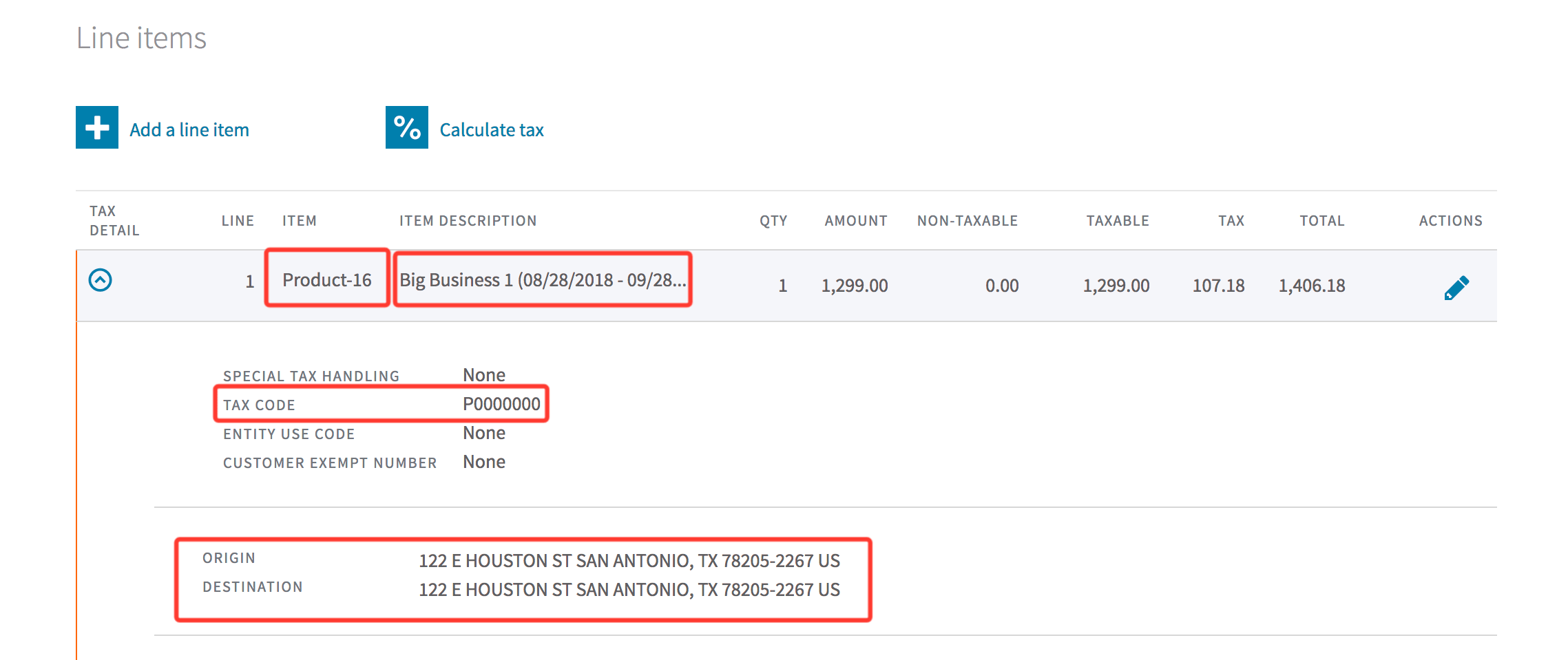

Line item mapping

| From (Advanced Billing) | Prefix | To (Avalara) | Notes |

| Product ID | Product-{product_id} | ITEM | |

| Component ID | Component-{component_id} | ITEM | |

| Product name | CHARGIFY-SUB-{subscription_id}-INV-{invoice_id} | ITEM DESCRIPTION | With subscription date or to component name field |

| Product Tax Type | TAX CODE | ||

| Component Tax Type | TAX CODE | ||

| Tax Origin Address | ORIGIN ADDRESS | ||

| Billing Address or Shipping Address | DESTINATION ADDRESS |

Relationship Invoicing Mapping between Advanced Billing and Avalara

Invoices mapping

For Relationship Invoicing only:

| From (Advanced Billing) | Prefix | To (Avalara) | Notes |

| Subscription ID & Invoice ID | CHARGIFY-CENTRIC-SUB-{subscription_id}-INV-{invoice_id} | DOCUMENT CODE | |

| Unpaid (Status) | Saved | ||

| Paid (Status) | Committed | ||

| Voided (Status) | Canceled | ||

| Canceled | Uncommitted | ||

| REFERENCE CODE | SUBSCRIPTION-GROUP-ID-{subscription_group_uid}, PARENT-INV-NUM-{parent_invoice_number} | Applicable if invoice segment | |

| Customer ID | CUSTOMER |

Invoices mapping

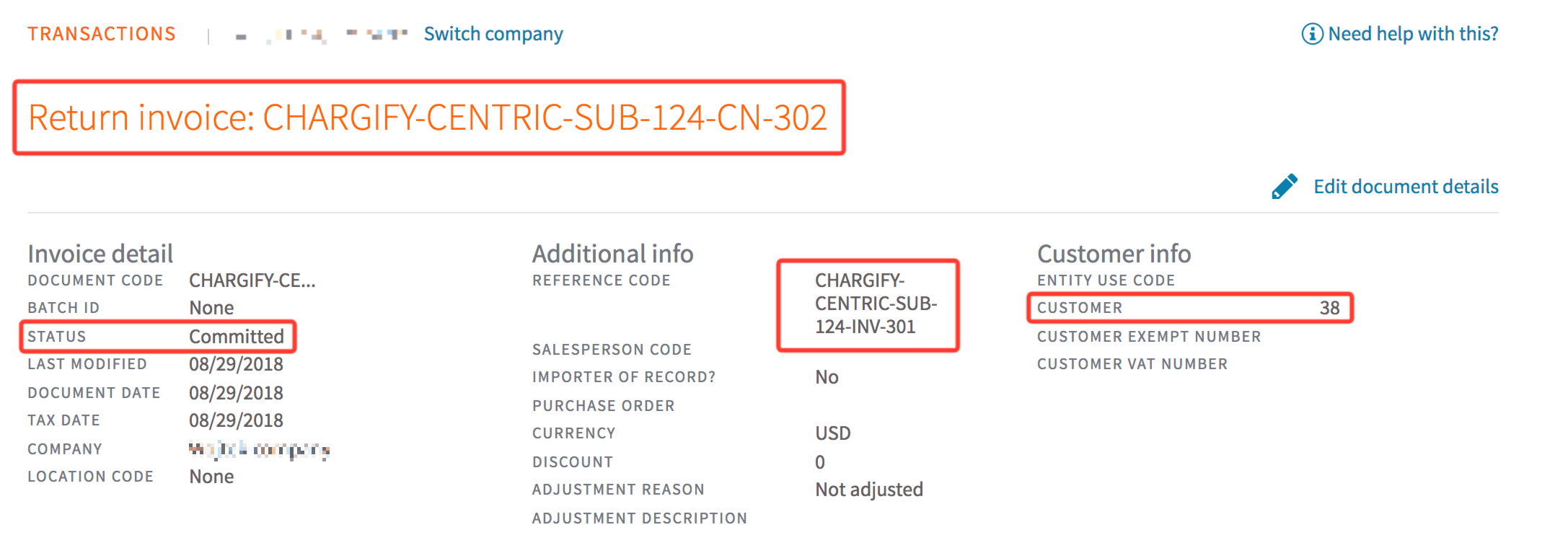

Invoices mappingCredit Notes mapping

For Relationship Invoicing only:

Credit notes sync occurs when they get created. It happens when invoice receive credit notes from prorated credits, refunds, manually applied service credits and voiding partially paid invoices operations.

| From (Advanced Billing) | Prefix | To (Avalara) | Notes |

| Credit note ID & Subscription ID | CHARGIFY-CENTRIC-SUB-{subscription_id}-CN-{credit_note_id} | DOCUMENT CODE | |

| Status | Committed | Always | |

| Invoice IDs | CHARGIFY-CENTRIC-SUB-{subscription_id}-INV-{invoice_id} | REFERENCE CODE | Origin invoices that were credited that were credited or refunded |

| Customer ID | CUSTOMER |

Credit Note mapping

Credit Note mappingLine item mapping

- Here we follow the same mapping patterns as for Invoice Billing