When you are configuring taxes on your Products and Components, there are a few key areas to cover. Tax settings, product settings and, if applicable, component settings.

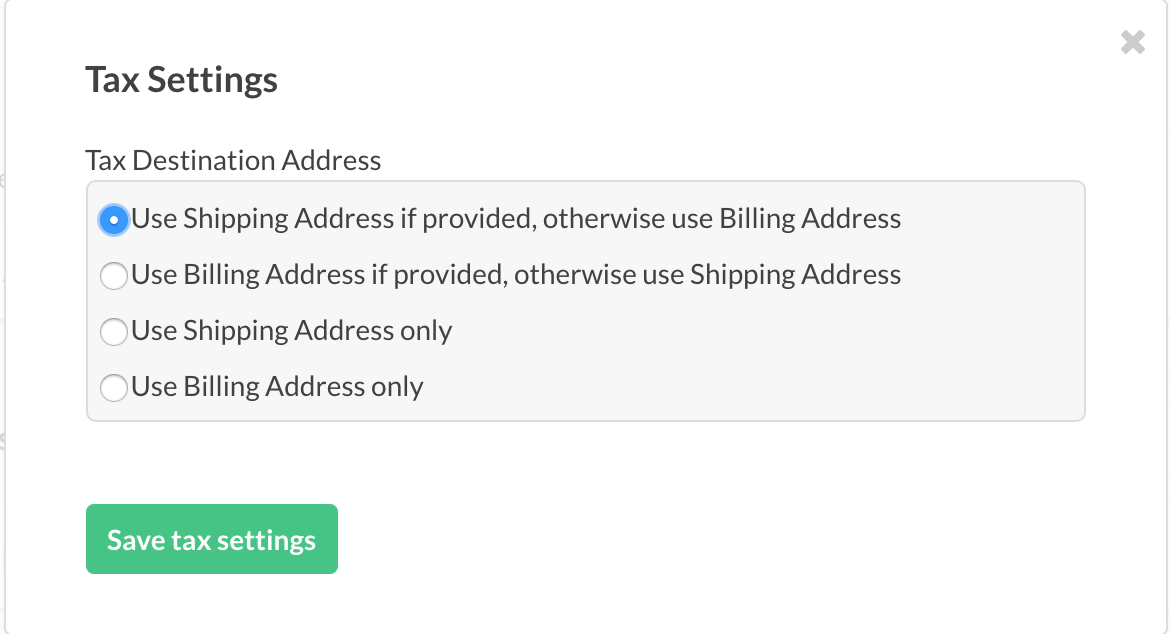

Tax Settings

Please inspect the setting ‘Tax Destination Address’. By default, taxes are calculated using the customer’s shipping address if available. By clicking edit, a few more options are exposed:

Select which address to use to define taxes

Depending on your selection here, this will define how you configure your products.

- Use Shipping Address if provided, otherwise use Billing Address

If you select this option, you must enable the setting to ‘Require Shipping Address’ or ‘Require Billing Address’.

- Use Billing Address if provided, otherwise use Shipping Address

If you select this option, you must enable the setting to ‘Require Billing Address’ or ‘Require Shipping Address’.

- Use Shipping Address only

If you select this option, you must enable the setting to ‘Require Shipping Address’. If a shipping address is not provided, no taxes will be collected. Additionally, if only a billing address is provided, no taxes will be collected.

- Use Billing Address only

If you select this option, you must enable the setting to ‘Require Billing Address’. If a billing address is not provided, no taxes will be collected. Additionally, if only a shipping address is provided, no taxes will be collected.

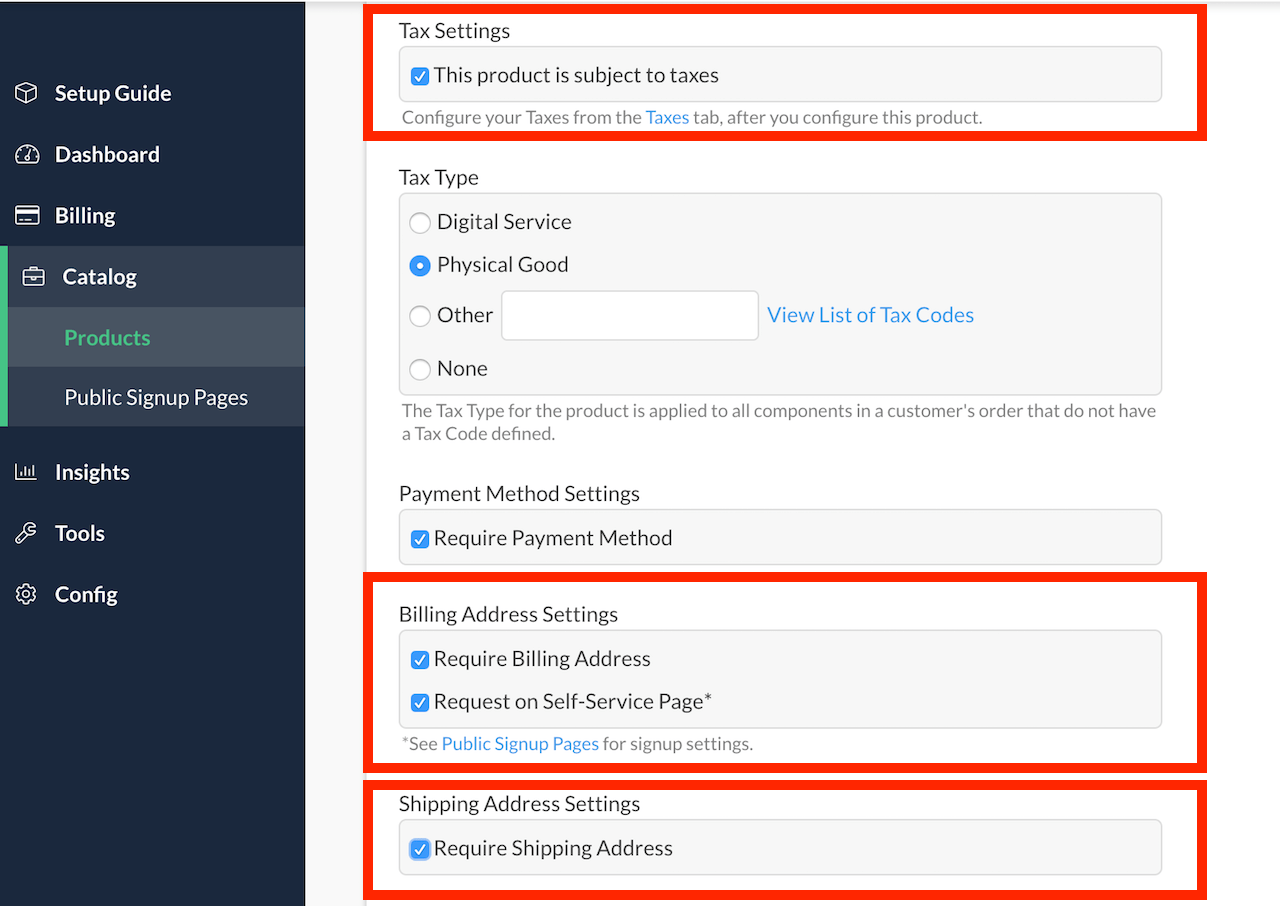

Options to require billing or shipping address. One must be checked if you intend on collecting taxes.

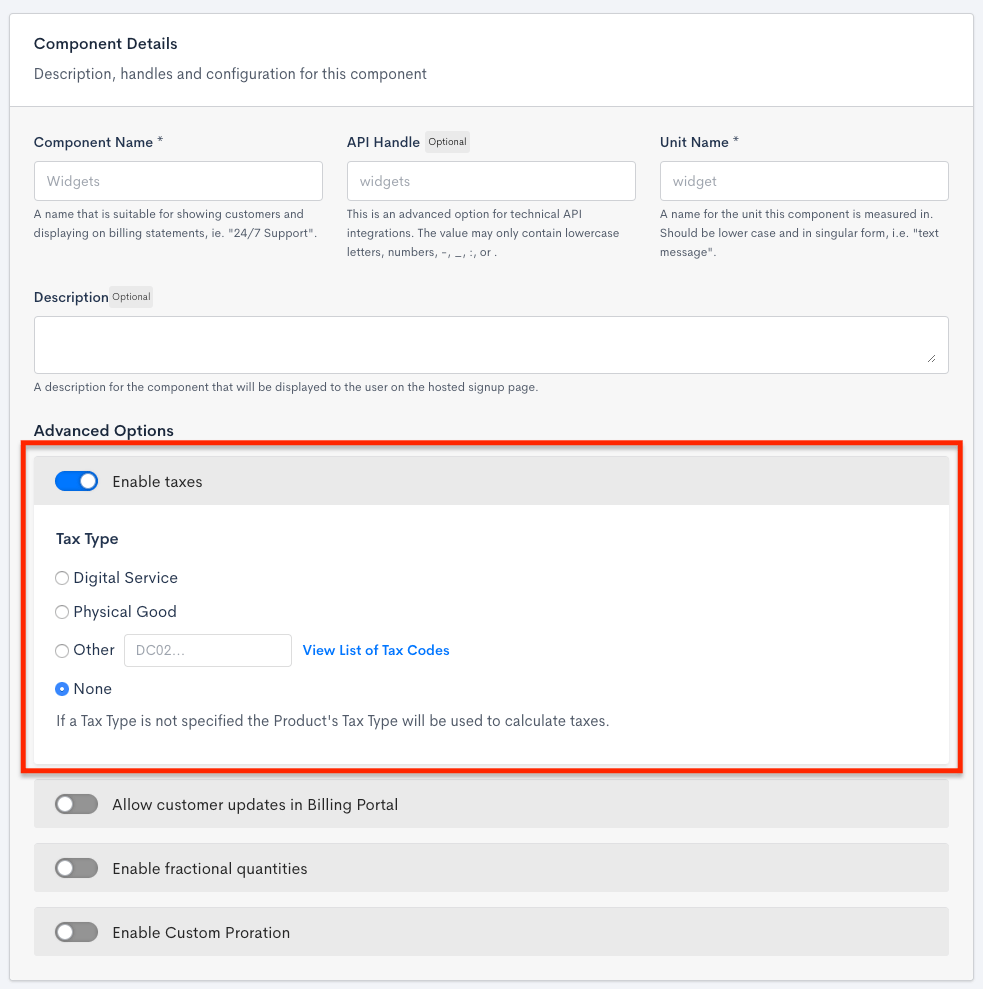

Component Example

Option to enable taxes for components