Introduction

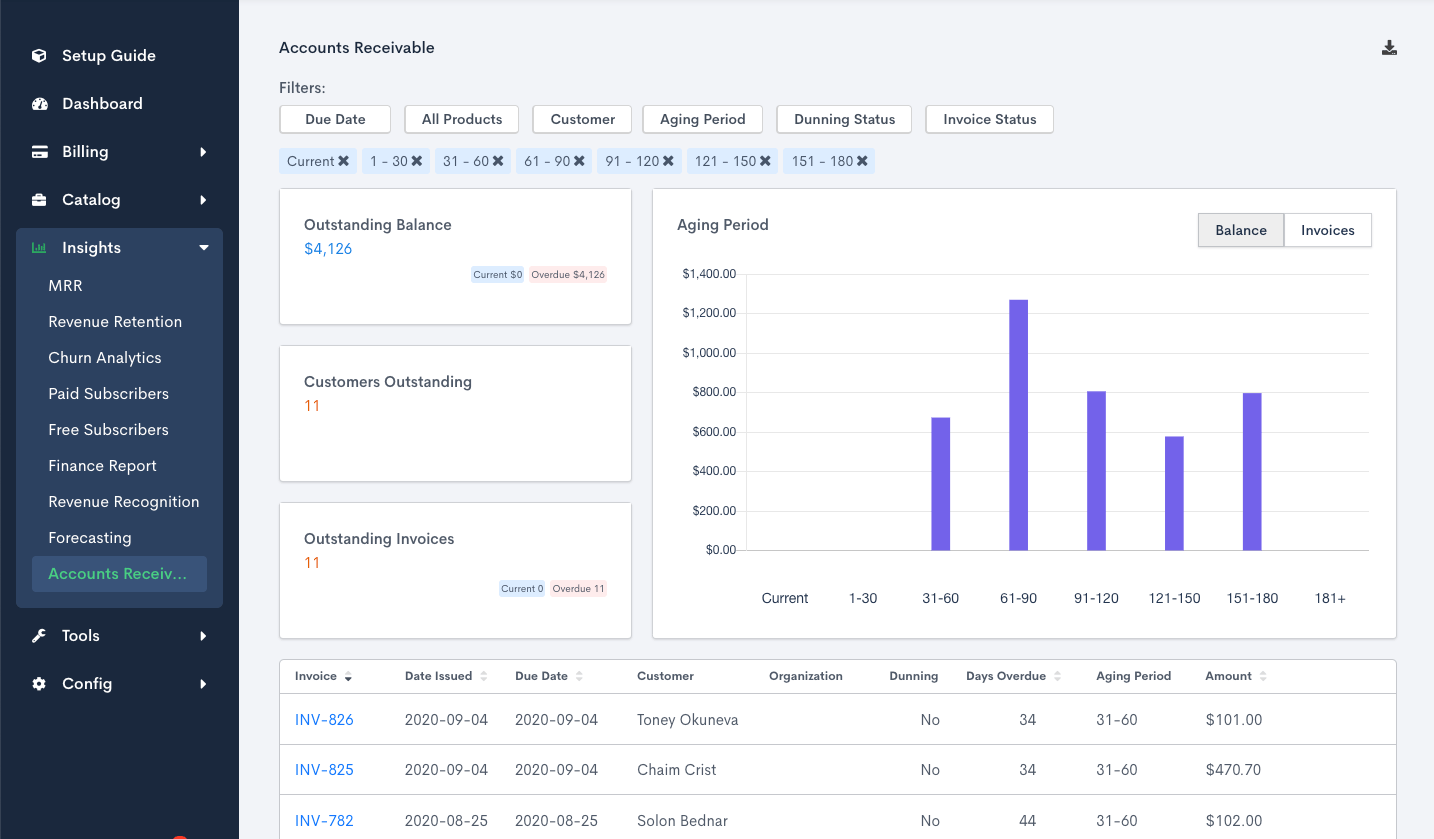

The Accounts Receivable report tracks your customers’ outstanding balances and credit balances. This report breaks down outstanding balances into invoiced amounts, payments, and refunds. Similarly, credit balances break down into prepayments balances and unapplied credits. The CSV export allows you to see all of these elements and their corresponding details, including customer information, transaction dates, days outstanding, and days overdue.

Your accounting team can use the Accounts Receivable report to measure outstanding balances and make provisions for doubtful accounts.

Your revenue operations team can use the Accounts Receivable report in tandem with the Revenue Retention report to manage overdue accounts and to identify unpaid invoices that can be paid by allocating existing balances.

How to Access

To open the Accounts Receivable report, go to the "Insights" tab and click the “Accounts Receivable” link.

Accounts Receivable

Key Concepts

- Outstanding Balance is the amount the customer owes the merchant (you) for any invoice. This is calculated as invoice amount less net payments (gross payments less refunds) where the result is a positive value.

- Outstanding Balances are split into Current and Overdue based on whether the invoice due date has passed.

- Credit Balance is the amount the merchant (you) owes the customer. These come in the form of unapplied prepayments and unapplied credits.

- Days Outstanding - the number of days that have passed since the invoice was issued. Note: the CSV export also uses the Days Outstanding column to also show the number of days that have passed since the creation of a service credit or prepayment. For certain reporting, you may want to filter service credits and prepayments by setting aging_category = ‘Invoice’.

- Days Overdue - the number of days that have passed since the invoice was due. Invoices that have not yet come due will show a negative for Days Overdue. Days Overdue serves as the input for the Aging Period.

Using the CSV export

The CSV export will serve as your tool of choice for your close-the-books process and any in-depth analysis.

You can export the CSV by clicking the Export icon in the upper-right corner.

From there, you are able to choose one of two export options: Accounts Receivable Detail or Invoice Application Detail.

Accounts Receivable Detail

You can export the CSV by clicking the download icon in the upper-right corner.

Each line in the CSV export represents one of the following: invoices with an outstanding balance (calculated as invoice amount less net payments), unapplied prepayments, and unapplied credits. You can filter on or sort by the aging_category field to identify which of these a line represents.

We have ordered CSV export columns from left to right beginning with reference IDs, followed by customer information, then aging category and invoice status, key dates, amounts, aging buckets, and ending with totals.

All amounts (e.g. billed_amount, payment_amount) are shown in their billed currency and also in the Site primary currency after FX rate conversion (e.g. converted_billed_amount, converted_payment_amount).

For a complete list of the columns in the CSV export, please view the export documentation.

Invoice Application Detail

This export option requires selection of a date range before the export will begin. Any invoices issued during the selected period will be included in the export. Please note that the date range applies only to Invoice Issue and any payments, credits, or refunds outside of that range applied to an invoice within the range will be included in the export.

Each line in the CSV export represents a payment, credit, or refund applied to an invoice, regardless of invoice outstanding balance. The invoice information will be stored in columns A - T with applied transaction data in columns U - AD. For invoices that have no related payments, credits, or refunds, columns U - AD will be blank. If there are multiple applied transactions for a single invoice (e.g. INV-1 for $500 had PMT-1 for ($250) applied as well as CN-1 for ($250)) there will be a row for each applied transaction in the export. As a result, the invoice data in columns A - T will be identical for both rows, with columns U - AD differing based on the applied transaction.

All amounts (e.g. invoice_total_amount, invoice_outstanding_balance, original_amount, applied_amount) are shown in their billed currency.

For a complete list of the columns in the CSV export, please view the export documentation.

Using the UI

The Accounts Receivable UI provides an overview of your customers’ outstanding balances and helps you quickly discover balance details for specific customers or invoices.

All metrics, graphs, and tables are driven by the filters at the top of the UI.

The UI provides several at-a-glance metrics you can find in the top left of the UI:

- Outstanding Balance - sum of invoice balances where the customer owes the merchant

- Customers Outstanding - distinct count of customers with outstanding invoices

- Outstanding Invoices - count of invoices with outstanding balances

The top right of the UI contains the Aging Period graph which breaks down your outstanding balances by aging bucket. You can toggle between seeing a sum of the balance or a count of invoices.

If you are using multicurrency, Outstanding Balance at-a-glance and the Aging Period graph are shown in the Site primary currency.

Further down, you will find the Invoice List which details all of your outstanding invoices.

We show any unapplied credits or prepayments at the end of the row. To apply it, you need to open the invoice page and “Record Payment”. You can navigate to an invoice by clicking on the invoice number (e.g. INV-123).