ACH stands for Automated Clearing House and sometimes is referred to as EFT (electronic funds transfer) or ECP (electronic check processing). Some companies use the term “eCheck” instead. In this guide, all of these terms are used interchangeably.

Enabling ACH allows your customers to pay using their checking accounts. ACH is currently only supported in the US for Authorize.Net and Stripe. Forte EFT is available in both the US and Canada.

eCheck Basics

-

You must use Authorize.Net or Forte or Stripe or BlueSnap as your payment gateway.

-

For Authorize.Net, Stripe, or BlueSnap, you must be a US-based merchant, billing US-based customers.

-

If you’re already using Advanced Billing with Authorize.Net as your payment gateway, you need to get approved for ACH/eCheck processing through your Authorize.Net account.

-

You can apply for an Authorize.Net account or create a Stripe account if you do not have one.

-

Alternately, you can apply for an eCheck-only account with Authorize.Net.

Which Gateway?

Depending on which gateway you are using, Advanced Billing has created separate guides to walk you through the process of working with ACH. Authorize.Net, Forte or BlueSnap user? Click here. Stripe user? Click here.

How ACH Payments Work in Advanced Billing

You’ll notice that it’s not possible to enter ACH-based information by a brand new subscriber on Public Signup Pages.

Allowing bank account info to be entered by a brand new subscriber on a Public Signup Page is not a permitted workflow. Before using ACH as a payment method, the payment method and/or subscriber must be verified before funds can be withdrawn from their bank account. The verification path varies based on the gateway. This is the main reason we’ve created separate guides for using ACH with Advanced Billing.

Here’s high-level overview of how ACH works with Advanced Billing:

- Your customer signs up for your product using the product’s Public Signup Page.

- They are not permitted to enter bank account info on that form

- They will need to have them sign up with a credit card OR

- Sign up for a free product OR

- Sign up for a paid product that has a free trial period.

The ideal situation is to have them sign up for your product using a credit card. At a later point, you’ll prompt them to enter their banking information and begin using ACH.

Authorization Agreement

ACH customers must agree to authorization terms when entering their bank account in Advanced Billing. You are required to obtain permission from the customer prior to debiting their account.

To help with this, Advanced Billing will display ACH Authorization Agreement text on the Self-Service Page where subscribers enter their bank account information. If you are using another method to collect bank account information, you will need to take care of presenting the terms and obtaining the customer’s permission.

To be clear, the other ways that bank account information can be collected is:

- API

- Advanced Billing application by operator

Advanced Billing will also email your customer a copy of this agreement. In order to have this agreement automatically sent to your subscribers, you can configure the option to send ACH Authorization Agreement Email on the email settings page.

Emails When Anything Changes

ACH guidelines require you to notify your customer if there is any change to the recurring amount to be taken, or to the date that it will be taken. In other words, any change at all since you last notified them of what to expect.

We also recommend that you turn on the Upcoming Renewal Email in your site settings. This is an email we can send to your customers, telling them how much they will be charged, 3 days before they are charged.

Multiple Payment Profiles

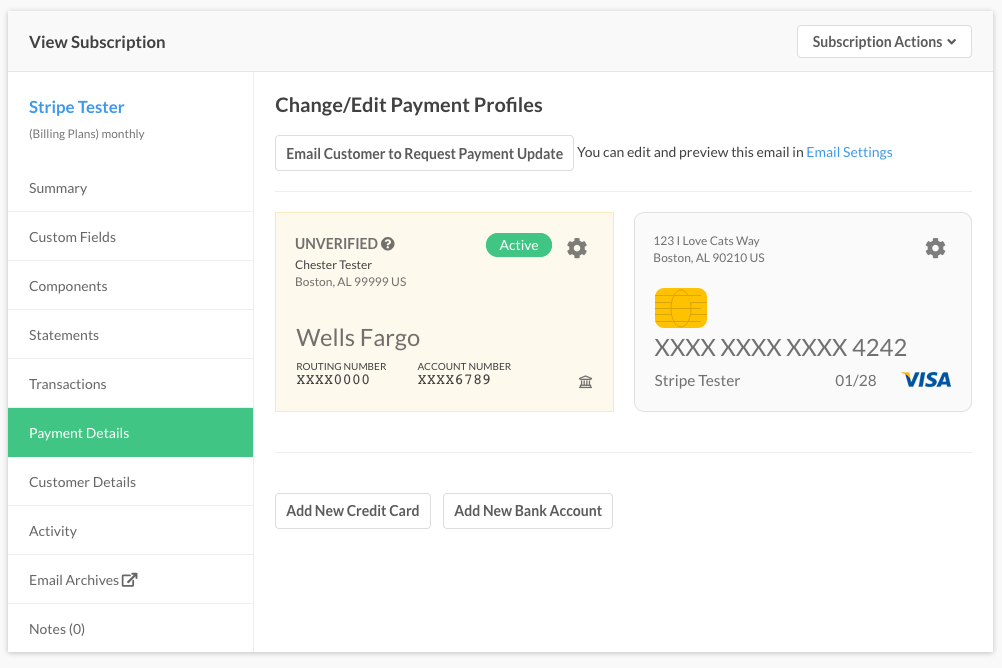

Your customer can have credit cards AND bank account info on file. You or they will simply choose which profile is the active payment method being used for a specific subscription.

Example of multiple payment profiles in a subscription

ACH Testing

If you are using the Advanced Billing test gateway, you may use a simulated bank account and routing numbers of your choice. For more information on Advanced Billing’s test gateway, please view our documentation.

Retries When ACH Payments Fail

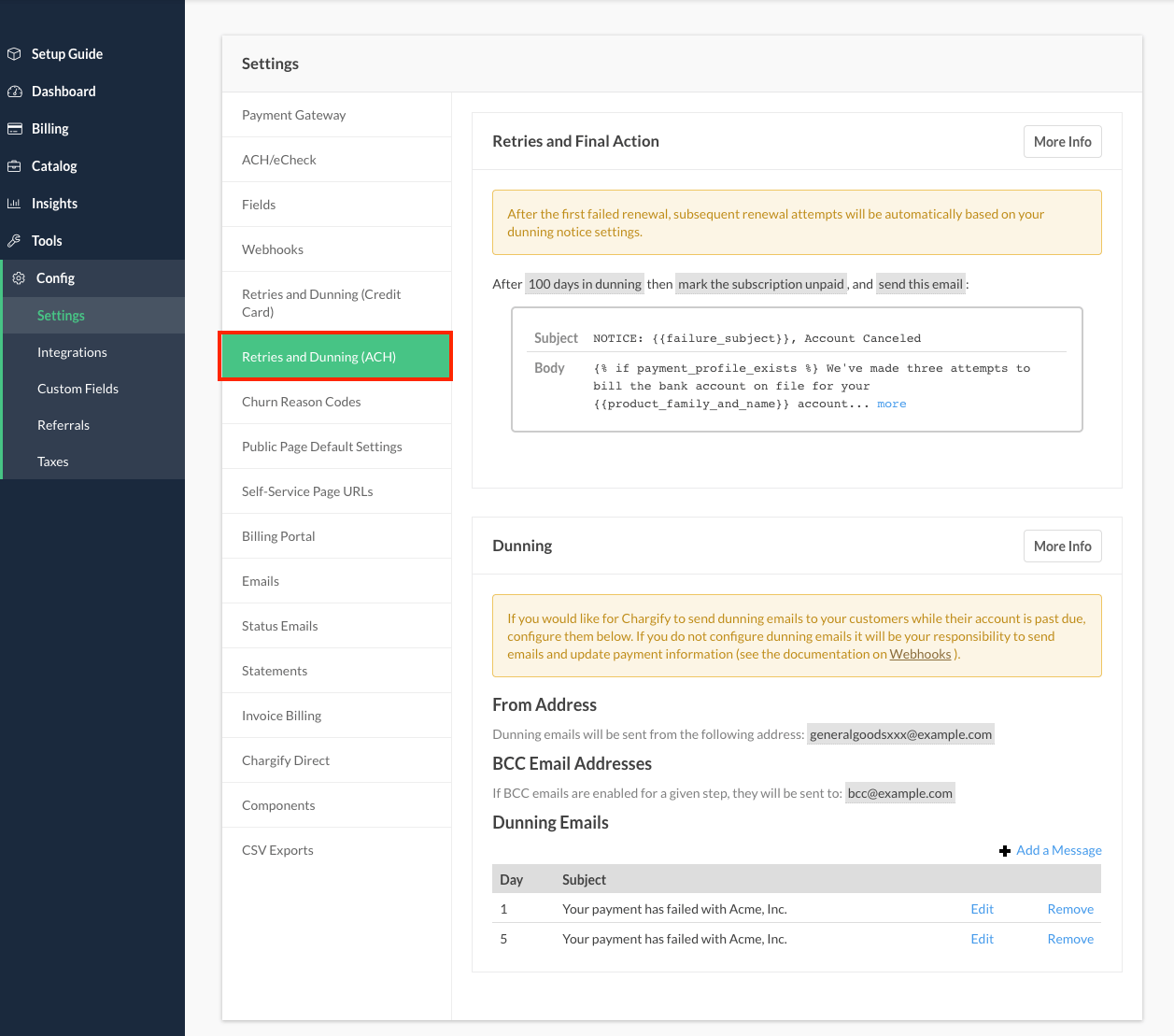

ACH guidelines dictate tighter rules for retrying failed ACH payments (versus credit cards). So we created a separate dunning/retry system for ACH payments. You will set up a different retry schedule and emails for customers paying via ACH.

Note that the guidelines do not allow you to try more than 3 times, and after 3 failed attempts, we must forever stop trying to collect on that arrangement. Basically, if your customer cannot pay after 3 tries, you will no longer be able to try – you will need to go back to them and start over on that particular payment plan.

Dunning settings for ACH payment method subscribers